ADA Price Prediction: Navigating Resistance and Technical Signals

#ADA

- ADA trades below 20-day MA at $0.8198, indicating short-term bearish pressure

- MACD shows slight bullish momentum at 0.004778 despite negative histogram

- Critical resistance at $0.99 with potential short squeeze of $164 million positions

ADA Price Prediction

Technical Analysis: ADA Shows Mixed Signals Near Key Support

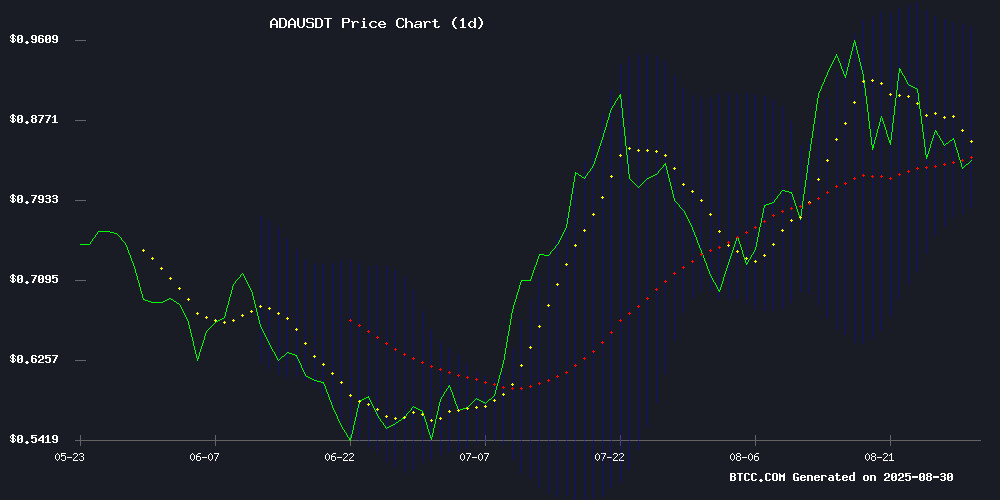

According to BTCC financial analyst John, ADA is currently trading at $0.8198, below its 20-day moving average of $0.8793, indicating potential short-term bearish pressure. The MACD reading of 0.004778 suggests some bullish momentum, though the negative histogram at -0.037017 points to underlying weakness. The Bollinger Bands show ADA trading closer to the lower band at $0.7829, which could act as immediate support. John notes that a break below this level might trigger further downside toward $0.75.

Market Sentiment: ADA Faces Critical Resistance Amid ETF Developments

BTCC financial analyst John comments that recent news highlights both challenges and opportunities for ADA. The $0.99 resistance level remains critical, with $164 million in short positions at risk if broken. The community review of Ouroboros Leios could bring technical improvements, while the SEC's ETF delay creates uncertainty. John suggests that these factors, combined with the broader market rebound, create a cautiously optimistic sentiment among traders.

Factors Influencing ADA's Price

Cardano Price Faces Critical Resistance at $0.99 with $164 Million Shorts at Risk

Cardano's ADA is testing a pivotal resistance level at $0.99, a breach of which could trigger a significant rally. Analysts warn that over $164 million in short positions are exposed to liquidation if the price breaks higher. Derivatives data from Binance, OKX, and Bybit highlight heightened liquidation risks.

The asset currently trades near $0.83, with $1.19 identified as the next major hurdle. A successful breakout could pave the way for a retest of ADA's 2021 all-time high near $3.09. Technical patterns show consolidation, suggesting traders are positioning for a decisive move.

Market observers note Cardano's resilience after repeated tests of support levels. The concentration of shorts at $0.99 raises the possibility of forced buying pressure if resistance breaks—a scenario that could amplify upward momentum.

Cardano’s Ouroboros Leios Proposal Opens for Community Review

Cardano has unveiled its Ouroboros Leios upgrade proposal, marking a pivotal step toward enhancing network throughput. The Cardano Improvement Proposal (CIP) is now accessible in the Cardano Foundation’s repository, inviting community feedback before implementation.

Nicolas Biri, Input Output’s Director of Software Architecture, emphasized the milestone’s significance while cautioning against premature celebration. The team seeks consensus on design trade-offs, including formal specifications, script budget optimizations, and attack resistance.

The draft incorporates prior feedback on failed transactions and adheres to its August submission timeline. This iterative approach underscores Cardano’s commitment to decentralized governance and technical rigor.

Cardano's ADA Rises Amid SEC ETF Delay and Market Rebound

Cardano's ADA token gained 2% to $0.87 as the crypto market recovered, fueled by expectations of a Federal Reserve rate cut in September. The CoinDesk 20 Index rose 2.8%, signaling renewed risk appetite after initial volatility following Fed Chair Jerome Powell's Jackson Hole comments.

Altcoins led the rebound, with ADA emerging as a standout. Traders viewed the earlier pullback as temporary, with accumulation activity picking up across the sector.

The SEC delayed its decision on Grayscale's proposed spot Cardano ETF until October 2025, mirroring its cautious approach to crypto ETFs. Regulators cited standard concerns around market manipulation and investor protection, creating regulatory uncertainty that failed to dampen ADA's momentum.

Is ADA a good investment?

Based on current technical and fundamental analysis, ADA presents a mixed investment case. The price is below key moving averages, suggesting short-term caution, but the MACD shows some bullish momentum. News regarding ETF developments and protocol upgrades could provide future catalysts.

| Metric | Value | Implication |

|---|---|---|

| Current Price | $0.8198 | Below 20-day MA, bearish short-term |

| 20-day MA | $0.8793 | Resistance level |

| Bollinger Lower Band | $0.7829 | Key support level |

| MACD | 0.004778 | Slight bullish momentum |

Investors should monitor the $0.99 resistance break and ETF news for clearer direction.